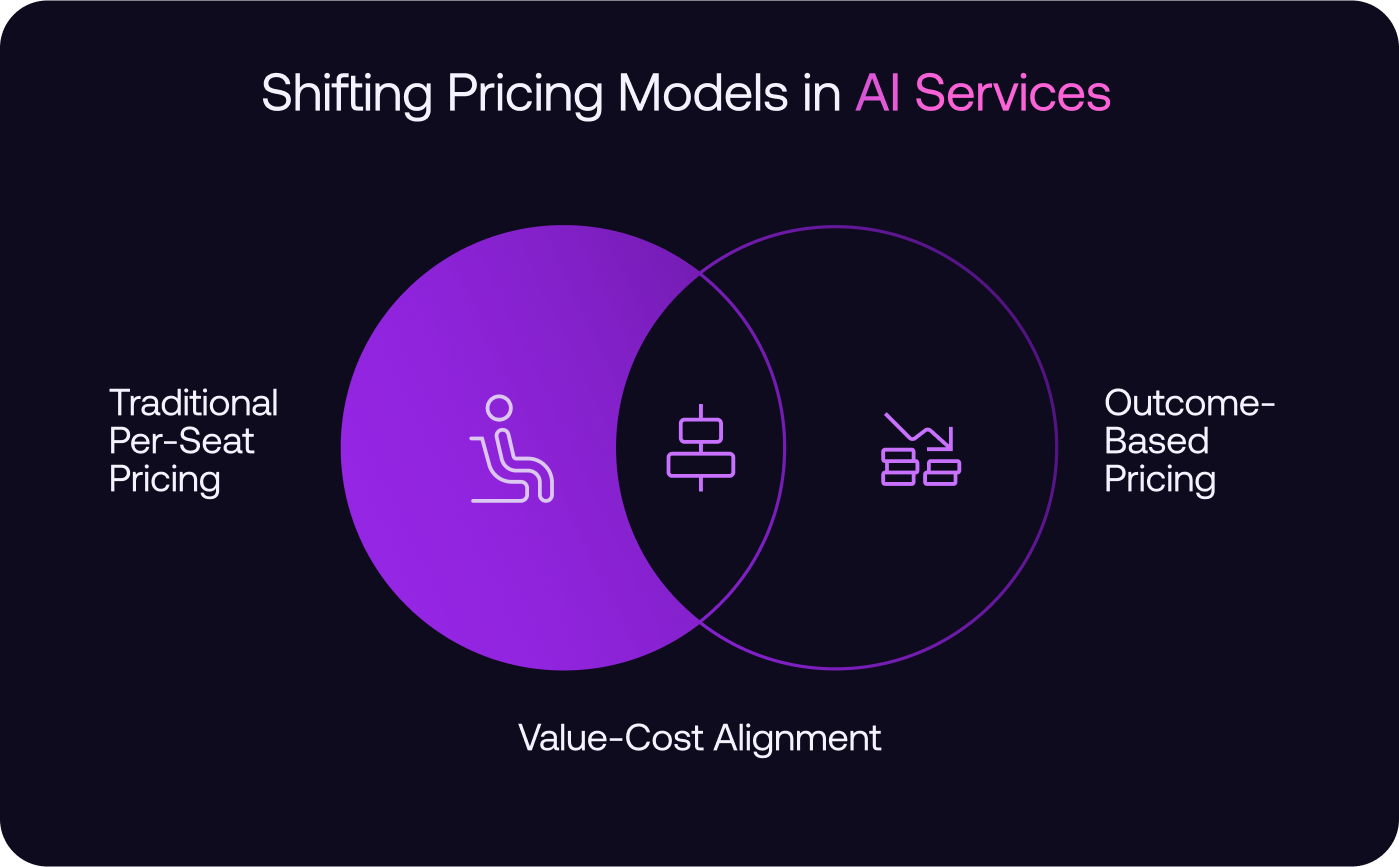

The tech world has been buzzing lately with discussions about shifting from traditional per-seat pricing to consumption-based, outcome-driven models. The debates surrounding the practical realities of such a seismic shift got me thinking deeply about our own journey at graph8.

When you're in the thick of building a startup, especially one leveraging cutting-edge AI, pricing isn't just a line item—it's a reflection of your philosophy, your understanding of the market, and your commitment to your customers. I want to share how we at graph8 grappled with these challenges and why we ultimately decided on a fixed, all-inclusive pricing model.

Chasing the Allure of Outcome-Based Pricing

In the early days of graph8, the allure of outcome-based pricing was almost irresistible. The logic seemed airtight: charge clients based on the tangible results our AI delivers. It's clean, it's fair, and it aligns our success directly with that of our clients. With AI's potential to revolutionize industries and deliver unprecedented efficiencies, why wouldn't we align our pricing with the outcomes we achieve?

We weren't alone in this thinking. Thought leaders like Sarah Tavel were advocating for startups to "sell work, not software." In her article, she argued that by leveraging AI to deliver actual work products, startups could tap into markets that were previously unattractive due to pricing and go-to-market limitations. The idea was to bypass selling software that improves productivity by 10% and instead sell a service that delivers 95% productivity improvements.

This resonated with us. The concept of providing direct value through AI-driven outcomes felt like the future. We imagined a world where clients paid us for the specific, measurable results we delivered—a perfect alignment of incentives.

The Cracks Begin to Show

But as we delved deeper, doubts started creeping in. One night, after yet another marathon strategy session, I found myself staring at a whiteboard filled with projections, charts, and what-if scenarios. A question lingered at the back of my mind:

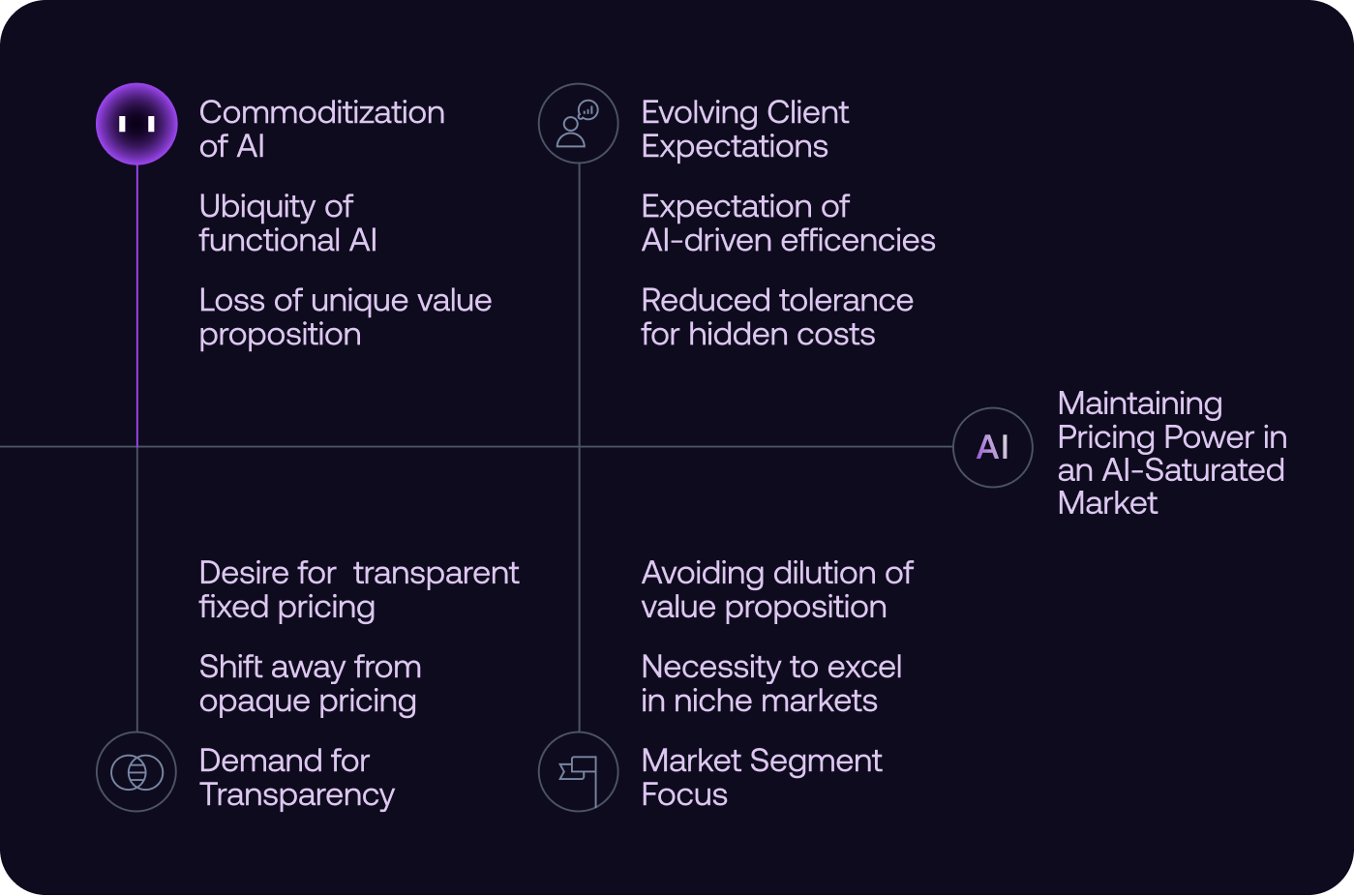

What happens when AI becomes ubiquitous and functional AI agents are commoditized?

If everyone has access to AI that can perform tasks once considered premium, how sustainable is it to charge a premium based on outcomes that might soon be industry standard? The more I thought about it, the more I realized that outcome-based pricing might be a short-term strategy at best.

Consider the trajectory of technology adoption. Early adopters might be willing to pay a premium for cutting-edge solutions, but as technology matures and becomes more widespread, the market adjusts. Prices drop, competition increases, and what was once a differentiator becomes a baseline expectation.

We saw parallels in other industries. Remember when GPS navigation systems were a luxury add-on in cars? Now, it's a standard feature, or we simply use our smartphones. The value shifts from the technology itself to the experiences and services built on top of it.

Breaking It Down

Assumption 1: AI Outcomes Will Always Command a Premium

At first glance, it seems reasonable that delivering superior outcomes through AI should allow us to charge more. But breaking it down, we realized:

- AI Accessibility: As AI tools and platforms become more accessible, the barrier to entry lowers. Competitors can emerge rapidly, offering similar outcomes at reduced prices.

- Client Expectations: Over time, clients will come to expect AI-driven efficiencies as standard. The novelty wears off, and the willingness to pay a premium diminishes.

Assumption 2: Outcome-Based Pricing Aligns Incentives

While it's true that aligning our pricing with client success sounds ideal, it introduces complexities:

- Measurement Challenges: Accurately measuring outcomes attributable solely to our platform can be difficult. Variables outside our control can impact results, leading to disputes or dissatisfaction.

- Revenue Predictability: Tying revenue directly to outcomes can lead to volatility. For a startup, predictable cash flow is crucial for planning and growth.

Assumption 3: Clients Prefer Outcome-Based Pricing

We believed that clients would appreciate paying for results rather than services. But digging deeper:

- Trust Factors: Clients may be wary of models where costs can fluctuate unpredictably based on outcomes, preferring the certainty of fixed pricing.

- Complexity Aversion: Simpler pricing models are easier to understand and budget for. Complexity can be a barrier to adoption.

The Shift in Platform Value: From Humans to Bots

Another factor we couldn't ignore was the broader shift in platform value—from human interactions to bot interactions. As AI agents become more sophisticated, they can mimic human behavior across various applications without the need for deep integrations. This shift has profound implications:

- Reduced Lock-In Effect: Traditional SaaS platforms have relied on integration depth to retain customers. If AI agents can interact with platforms without those integrations, the lock-in diminishes.

- Increased Flexibility for Clients: Customers can switch between platforms more easily, intensifying competition and making it harder to maintain pricing power.

The Demise of Opaque Pricing Models

Simultaneously, we observed a growing distaste for opaque, negotiable pricing models—the kind often associated with enterprise software sales. Clients are increasingly demanding transparency and fairness. The "used car salesman" approach is becoming a relic of the past.

I was exposed to ideas from 37signals with their concept of paying for software Once and as a client of Roam being exposed to their monthly, fair and transparent pricing policy. They've embraced transparent, fixed pricing models, refusing to play the traditional SaaS game of opaque pricing tiers and endless negotiations. It was refreshing—a nod to what I believe is the future of SaaS pricing.

This trend aligns with the broader move toward customer empowerment and away from vendor-controlled dynamics.

Our Decision: Embracing Fixed, Transparent Pricing

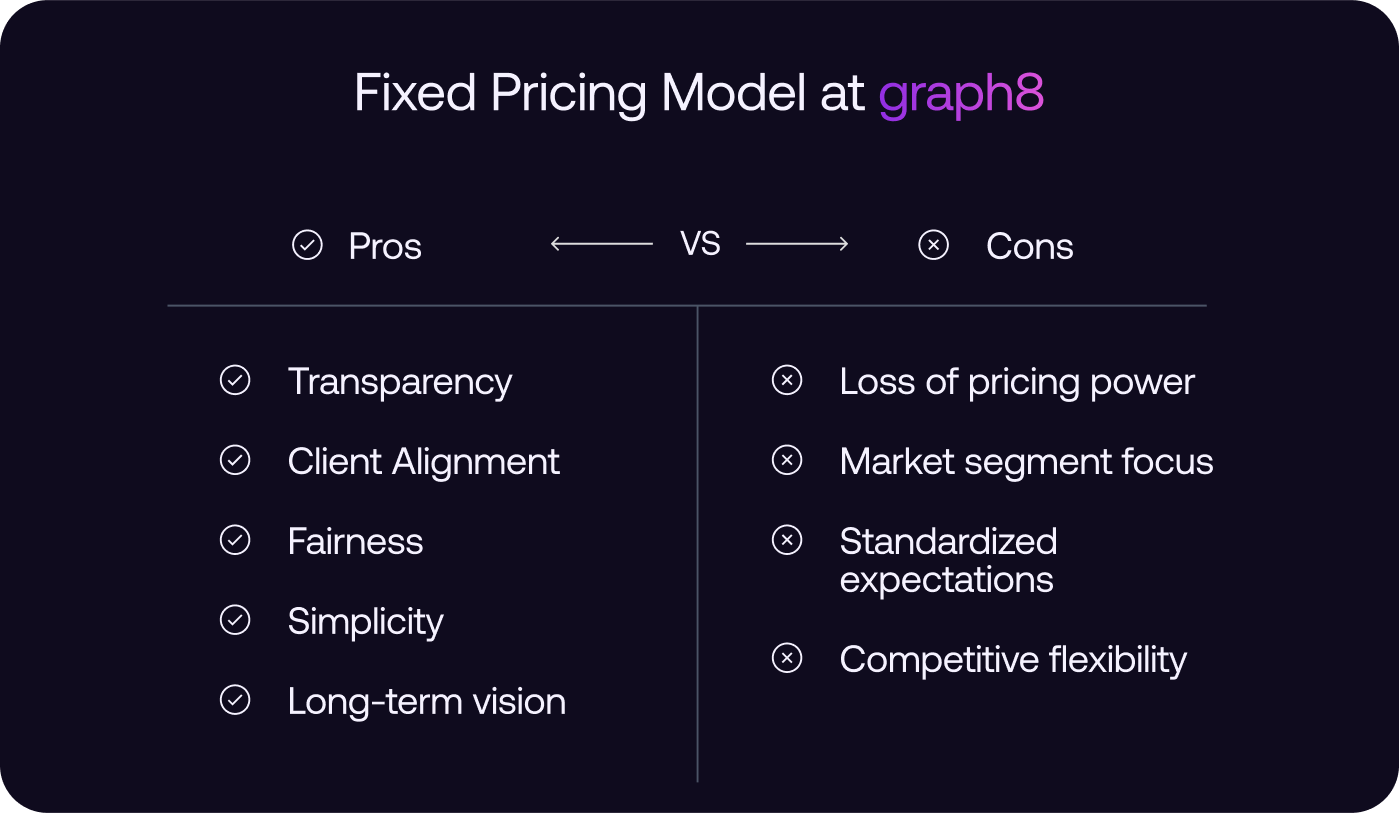

Taking all these factors into account, we decided to adopt a fixed, all-inclusive pricing model at graph8. Here's why:

- Building Trust Through Transparency

By offering a clear, fixed price, we eliminate uncertainty. Clients know exactly what they're paying and what they're getting. This transparency fosters trust—a critical component of long-term business relationships. - Aligning with Market Expectations

As AI commoditizes, clients will expect the benefits of automation as a baseline, not a premium service. Fixed pricing acknowledges this reality and positions us as forward-thinking and client-centric. - Simplifying the Sales Process

Opaque pricing models often lead to prolonged negotiations and can deter potential clients. A fixed pricing model streamlines the sales process, making it easier for clients to say "yes." - Focusing on Delivering Genuine Value

Without relying on outcome-based premiums, we're challenged to continuously improve our platform and deliver exceptional value. It keeps us aligned with our clients' needs and the evolving market landscape.

Challenges and Trade-Offs

Of course, this decision wasn't without its challenges.

- Revenue Predictability vs. Potential UpsideFixed pricing provides predictable revenue streams, which is beneficial for planning and stability. However, it also means we might miss out on potential upside that could come from exceptional outcomes.

- Market SegmentationOur pricing model may not be ideal for all market segments. Smaller clients might find per-seat pricing more economical, while larger enterprises could benefit more from consumption-based models. We had to accept that we might not serve every segment equally well.

- Competitive PressureFixed pricing puts the onus on us to continually demonstrate value, especially as competitors adopt aggressive pricing strategies. We need to ensure that our offering remains compelling in a crowded market.

Reflecting on Sarah Tavel's Insights

Sarah Tavel's perspective on selling work instead of software was instrumental in shaping our thinking. She highlighted that AI opens doors to markets previously inaccessible due to traditional software pricing and go-to-market limitations.

However, we recognized that while selling work has its merits, it also assumes that the automation benefits remain with the provider. In reality, as AI becomes standard, clients will expect to capture these benefits themselves.

The Broader Industry Implications

Traditional pricing models are being questioned, and companies are experimenting with new approaches. But the transition isn't straightforward.

- Operational Overhaul

Moving to consumption-based pricing requires significant changes in how a company operates. Sales teams need retraining, revenue forecasting becomes more complex, and customer success takes center stage. - Wall Street Expectations

Public companies face the added pressure of meeting investor expectations. Predictable ARR is valued, and shifts in pricing models can introduce uncertainty that affects stock performance. - Customer Relationships

As Kyle Poyar pointed out in his linkedin post, the hard work begins after the contract is signed. With consumption-based models, every interaction becomes a potential churn point. Companies need to invest more in customer success and product engagement strategies.

Our Commitment to Clients

At graph8, our journey has reinforced the importance of aligning our pricing with our core values:

- Transparency

We believe in open communication and straightforward dealings. Our fixed pricing model is a manifestation of that belief. - Client-Centricity

Our success is tied to our clients' success. By removing pricing barriers and focusing on delivering value, we build stronger, more collaborative relationships. - Adaptability

The tech landscape is ever-changing. We're committed to staying agile, learning continuously, and adapting our strategies to meet emerging challenges.

Looking Ahead

The AI era is both exciting and unpredictable. As technologies evolve and markets adjust, companies will need to make tough decisions about how they position themselves and how they engage with clients.

For us, adopting a fixed pricing model was about more than just dollars and cents. It was a strategic decision grounded in first principles thinking, market observations, and a commitment to our clients.

We recognize that this path isn't without risks, but we believe it's the right one for us. It aligns with our vision of building lasting partnerships based on trust, delivering genuine value, and staying ahead of industry shifts.

Inviting Dialogue

I share our story not because we have all the answers, but because we're all navigating this new terrain together. I invite fellow founders, industry leaders, and clients to share their thoughts and experiences.

- How are you approaching pricing in the AI era?

- What challenges have you faced, and what insights have you gained?

- Do you believe outcome-based pricing is sustainable long-term, or do you see alternative models emerging?

By engaging in open dialogue, we can collectively shape the future of our industry in a way that benefits businesses and customers alike.

Our journey at graph8 is ongoing. We'll continue to question our assumptions, adapt our strategies, and strive to deliver exceptional value to our clients. The decisions we make today will set the foundation for our future, and we're committed to building that future thoughtfully and responsibly.